Are you ready to take control of your financial future? In this article, we will explore the world of online platforms for investing and wealth building. Now more than ever, individuals have the opportunity to grow their wealth and achieve financial independence through digital platforms. With the advancement of technology, investing and building wealth online has become more accessible and convenient. Whether you are a seasoned investor or just getting started, these platforms offer a range of options and features to help you reach your financial goals. Get ready to embark on a journey towards financial success as we delve into the exciting world of online investing and wealth building.

Understanding Online Platforms for Investing and Wealth Building

Online investment platforms refer to digital platforms that allow individuals to invest their money and build wealth through various financial instruments, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more. These platforms have gained immense popularity in recent years due to their accessibility and convenience.

Investors are increasingly turning to online platforms for several reasons. First and foremost, these platforms offer a wide range of investment options, allowing individuals to diversify their portfolios and potentially earn higher returns. Additionally, online platforms provide users with real-time data, charts, and market analysis to help them make informed investment decisions. They also often have lower fees compared to traditional brokerage firms, making investing more affordable for all.

Overview of Different Types of Online Investment Platforms

There are various types of online investment platforms available to cater to different investor needs. Here are a few popular ones:

-

Robo-advisory platforms: These platforms use algorithms and automation to provide personalized investment advice and manage portfolios on behalf of investors. They are ideal for beginners or those who prefer a more hands-off approach to investing.

-

Stock trading platforms: These platforms focus on buying and selling individual stocks and provide users with access to real-time stock quotes, news, and research tools. They are suitable for investors who want to actively trade stocks.

-

Peer-to-peer lending platforms: These platforms connect borrowers directly with lenders, cutting out the traditional banking system. Investors can earn returns by lending money to individuals or businesses. This type of platform is suitable for individuals looking for alternative investment options.

-

Real estate crowdfunding platforms: These platforms enable investors to invest in real estate assets, such as residential or commercial properties, alongside other investors. It provides access to real estate investments that were previously only available to high-net-worth individuals.

-

Social investing platforms: These platforms allow investors to follow and copy the investment strategies of successful traders or investors. They provide a social element to investing, allowing individuals to learn from others and potentially achieve better results.

Benefits of Using Online Platforms for Investing and Wealth Building

Using online investment platforms offers several advantages for investors. Here are some key benefits:

-

Accessibility and convenience: Online platforms provide investors with 24/7 access to their investment accounts, allowing them to manage their investments from anywhere at any time. This flexibility makes investing more convenient and accessible to a wider range of individuals.

-

Lower costs: Online platforms often have lower fees compared to traditional brokerage firms, as they eliminate the need for human intermediaries. This cost-saving benefit allows investors to keep more of their investment returns.

-

Investment education and resources: Many online platforms offer educational materials, resources, and tools to help investors enhance their knowledge and make informed investment decisions. These resources can include articles, courses, webinars, and investment calculators.

-

Diversification opportunities: Online platforms typically offer a wide range of investment options, allowing investors to diversify their portfolios easily. Diversification is an essential risk management strategy that can help mitigate losses and improve overall portfolio performance.

-

Enhanced transparency: Online investment platforms provide investors with real-time access to their investment data, account balances, transaction history, and performance metrics. This transparency enables investors to monitor the progress of their investments and make necessary adjustments when needed.

Choosing the Right Online Platform

When selecting an online investment platform, there are several factors you should consider to ensure it aligns with your investment goals and preferences.

-

Fees and charges: Evaluate the fee structure of different platforms, including account maintenance fees, trading fees, and any other charges associated with using the platform. Consider platforms that offer competitive pricing and transparent fee structures.

-

Investment options: Look for platforms that provide a wide variety of investment options to suit your investment strategy and risk tolerance. Consider whether you want to invest in stocks, bonds, ETFs, mutual funds, or alternative assets.

-

User interface and ease of use: Consider the user interface and overall user experience offered by the platform. Look for platforms that are intuitive, easy to navigate, and offer simple and transparent investment processes.

-

Research and analysis tools: Access to reliable research, analysis, and market insights can help you make informed investment decisions. Look for platforms that provide comprehensive research tools, real-time data, and access to market news and analysis.

-

Customer service and support: Consider the quality of customer service and technical support offered by the platform. Look for platforms with responsive and knowledgeable customer support teams that can assist you promptly in case of any issues or concerns.

Comparison of Popular Online Investment Platforms

To help you make an informed decision, let’s compare a few popular online investment platforms:

-

XYZ Investment Platform: XYZ offers a user-friendly platform with a wide range of investment options, including stocks, bonds, mutual funds, and ETFs. They provide access to extensive research and analysis tools for making informed investment decisions. XYZ has competitive pricing with low fees and charges.

-

ABC Robo-Advisor: ABC is a robo-advisory platform that uses algorithms to create and manage personalized investment portfolios based on your risk tolerance and investment goals. They provide automated rebalancing and tax-loss harvesting strategies. ABC offers a user-friendly interface and provides educational resources for beginner investors.

-

DEF Stock Trading Platform: DEF specializes in stock trading and provides real-time stock quotes, charts, and research tools. They offer a wide range of order types and customizable trading strategies for experienced investors. DEF charges competitive trading fees and provides 24/7 customer support.

Features to Look for in an Online Investment Platform

While specific platform features may vary, here are some essential features to look for in an online investment platform:

-

Account types: Look for platforms that offer various account types to suit your investment needs, such as individual accounts, joint accounts, retirement accounts (e.g., IRAs), and education savings accounts (e.g., 529 plans).

-

Security measures: Ensure that the platform has robust security measures in place to protect your personal information and investments. Look for platforms that utilize encryption technology, two-factor authentication, and secure data storage practices.

-

Portfolio management tools: Consider platforms that provide portfolio management tools, including asset allocation tools, performance monitoring, and risk assessment tools. These features can help you track the progress of your investments and make informed decisions.

-

Mobile app: A mobile app can provide greater flexibility and accessibility, allowing you to monitor and manage your investments on the go. Look for platforms that offer a well-designed and functional mobile app compatible with your device.

-

Additional services: Some platforms offer additional services, such as financial planning, retirement planning, or access to exclusive investment opportunities. Consider whether these services align with your long-term financial goals and aspirations.

By carefully considering these factors and comparing different online investment platforms, you can choose the one that best suits your investment objectives and preferences.

Getting Started with Online Investing

Now that you have chosen the right online investment platform, it’s time to get started with online investing. Here are the steps to follow:

-

Open an account: Visit the website of your chosen online investment platform and open an account. Provide the necessary personal information, such as your name, address, social security number, and employment details. Ensure the platform follows strict KYC (Know Your Customer) procedures for identity verification.

-

Fund your account: Once your account is open, fund it by transferring money from your bank account. Most platforms provide various funding options, including electronic funds transfer (EFT), wire transfer, or linking your bank account for automatic transfers.

-

Understand investment options: Familiarize yourself with the different investment options available on the platform. Take the time to research and learn about different asset classes, their potential risks and rewards, and how they align with your investment goals.

-

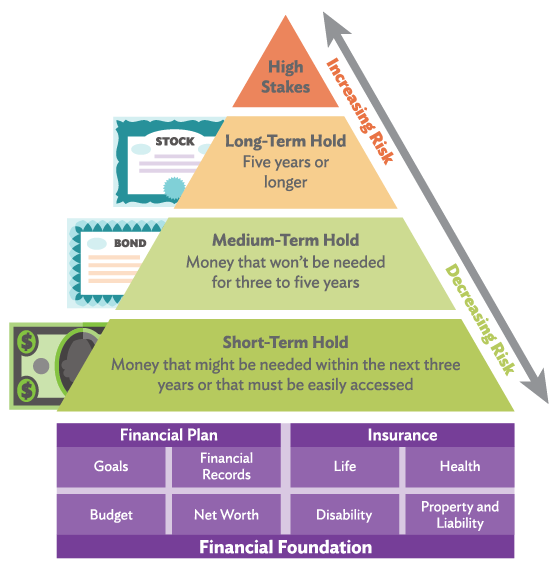

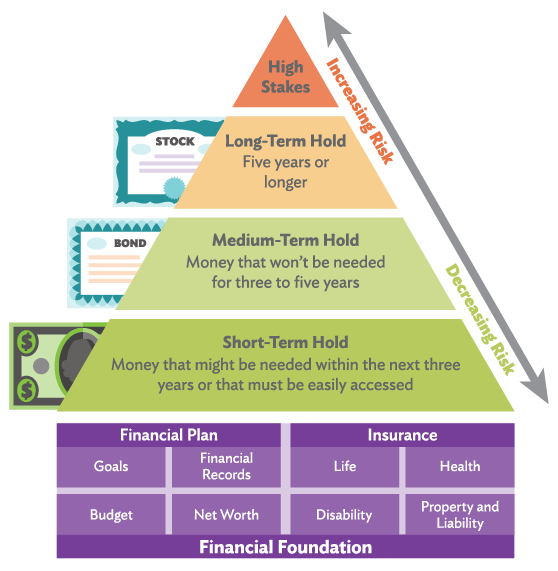

Create a personalized investment portfolio: Based on your risk tolerance, investment goals, and time horizon, create a diversified investment portfolio. Consider diversifying across different asset classes, sectors, and geographical regions to reduce risk and potentially maximize returns.

Building Wealth through Online Platforms

Online investment platforms provide various investment strategies and tools to help you build wealth over time. Here are some strategies to consider:

-

Utilize different investment strategies: Depending on your risk tolerance and investment goals, consider utilizing different investment strategies, such as value investing, growth investing, income investing, or a combination of these strategies. Each strategy has its own merits and helps diversify your investment approach.

-

Diversify your investments: Diversification is an essential risk management technique that involves spreading your investments across different asset classes, sectors, and geographical regions. This helps reduce the impact of any individual investment on your overall portfolio and potentially enhances returns.

-

Monitor and manage your investments: Regularly monitor the performance of your investments and make necessary adjustments based on market conditions or changes in your investment goals. Online platforms provide real-time data and analysis tools to help you stay informed and make informed decisions.

Risk Management and Investor Protection

While online investing offers numerous benefits, it is important to be aware of the risks involved and take steps to protect your investments and personal information.

-

Understand the risks: Educate yourself about the risks associated with different investment options, such as market risk, liquidity risk, and specific risks of individual investments. Reading prospectuses, researching investment products, and consulting financial professionals can help you understand the risks better.

-

Protect your personal information: Online investment platforms utilize high-security measures, but it is important to take steps to protect your personal information as well. Use strong, unique passwords for your investment accounts, enable two-factor authentication, and be cautious of phishing attempts or suspicious emails.

-

Ensure investor protection: Choose reputable and regulated online investment platforms that prioritize investor protection. Look for platforms that are registered with relevant financial regulatory authorities and have a strong track record of customer satisfaction.

Social Investing and Collaborative Wealth Building

Social investing platforms have gained popularity in recent years, offering a unique approach to wealth building. Here are some highlights of social investing and collaborative wealth building online:

-

Exploring social investing platforms: Social investing platforms allow investors to follow and copy the investment strategies of successful traders or investors. This social element enables individuals to learn from experienced investors, gain insights, and potentially achieve better investment results.

-

Benefits of collaborative wealth building online: Collaborative wealth building platforms bring together like-minded individuals who share investment ideas, strategies, and resources. By collaborating and pooling resources, investors can leverage collective knowledge and potentially access investment opportunities that may have been out of reach individually.

-

Joining investment communities and groups: Many online platforms offer investment communities, discussion forums, or groups where investors can connect with others, share insights, and engage in meaningful discussions. These communities allow individuals to tap into the collective wisdom of experienced investors and stay updated with market trends.

Automated Investing and Robo-Advisors

Robo-advisors are an emerging trend in online investing, utilizing automation and algorithms to manage investment portfolios. Here’s what you need to know about automated investing and robo-advisors:

-

Understanding the role of robo-advisors: Robo-advisors use algorithms to create and manage personalized investment portfolios based on an individual’s risk tolerance, investment goals, and time horizon. They automate the investment process, rebalance portfolios as needed, and provide ongoing portfolio monitoring.

-

Benefits of automated investing: Robo-advisors offer several benefits, including cost-effectiveness, convenience, and accessibility. They often have lower fees compared to traditional financial advisors and provide 24/7 account access. Robo-advisors can be a suitable option for individuals who prefer a hands-off approach to investing or are new to investing.

-

Choosing the right robo-advisor: When selecting a robo-advisor, consider factors such as fees, investment options, portfolio customization options, customer support, and the robo-advisor’s track record. Compare different robo-advisors to find the one that aligns with your investment goals and preferences.

Online Tax Planning and Reporting

Online investment platforms can assist with tax planning and reporting, simplifying the tax-related aspects of investing. Here’s how online platforms can help:

-

How online platforms help with tax planning: Many online investment platforms provide tax optimization strategies, including tax-loss harvesting, which involves selling investments at a loss to offset capital gains and reduce taxable income. These platforms provide automated tools to help you maximize tax efficiency.

-

Generating tax reports on online platforms: Online investment platforms generate tax reports, including your annual investment income, capital gains, and any tax deductions you may be eligible for. These reports can be exported or directly shared with tax professionals for easy tax filing.

-

Tips for maximizing tax efficiency: Consult with a tax advisor or utilize online tax planning resources to maximize tax efficiency. Consider strategies such as contributing to tax-advantaged accounts like IRAs or utilizing tax-efficient investment vehicles like index funds or ETFs.

Education and Resources for Investors

Online investment platforms play a significant role in providing educational resources and tools for investors. Here’s how you can utilize these resources:

-

Accessing educational materials and resources: Many online platforms offer educational materials, including articles, videos, courses, webinars, and eBooks, to help investors enhance their knowledge. Take advantage of these resources to learn about various investment topics, financial planning, and investment strategies.

-

Utilizing investment tools and calculators: Online platforms often provide investment tools and calculators to help you analyze investment performance, calculate potential returns, and assess risk. Utilize these tools to make informed investment decisions and evaluate different investment scenarios.

-

Staying updated with market trends and news: Online investment platforms provide real-time market data, news, and analysis to keep you updated with market trends. Stay informed about market developments, economic indicators, and important news that may impact your investments.

Future of Online Investing and Wealth Building

Online investing and wealth building are continuously evolving, driven by emerging trends and technologies. Here are some insights into the future of online wealth building:

-

Emerging trends and technologies: Artificial intelligence and machine learning are expected to play a significant role in the future of online investing. These technologies can enhance investment strategies, automate portfolio management, and provide personalized financial advice.

-

The role of artificial intelligence and machine learning: Artificial intelligence and machine learning algorithms can analyze large datasets, identify investment patterns, and provide sophisticated investment recommendations. These technologies have the potential to make investing more efficient, personalized, and accessible to a wider range of individuals.

-

Predictions for the future: The future of online wealth building may witness increased integration of financial planning tools, personalized investment recommendations based on individual goals and preferences, and improved user interfaces for a seamless investing experience. Additionally, advancements in blockchain technology and increased adoption of cryptocurrencies may open up new investment opportunities.

In conclusion, online investment platforms have revolutionized the way individuals invest and build wealth. These platforms offer accessibility, convenience, and a wide range of investment options to suit different needs and preferences. By choosing the right platform, utilizing various investment strategies, and staying informed through educational resources, investors can maximize their investment potential and pursue their financial goals in an increasingly digital world.