Imagine a world where you can access investment opportunities and grow your wealth with just a few clicks. No more complicated financial jargon or endless paperwork. In 2023, investing and wealth building online is breaking barriers, revolutionizing the way we approach our finances. With the power of technology at your fingertips, this article explores how online platforms are leveling the playing field and opening doors for individuals from all walks of life to achieve financial success. Get ready to discover the exciting possibilities and untapped potential of investing and wealth building in the digital age.

1. The Evolution of Investing and Wealth Building Online

The world of investing and wealth building has undergone a significant transformation with the rise of online platforms. In the past, investing was often seen as exclusive to a select group of individuals with extensive financial knowledge and access to brokers. However, with the advent of technology and the internet, investing has become more accessible and convenient for everyday individuals.

1.1 The Rise of Online Investing Platforms

Online investing platforms have revolutionized the way individuals participate in the financial markets. These platforms provide easy access to a wide range of investment options, allowing anyone with an internet connection to invest in stocks, bonds, mutual funds, and more. The rise of online platforms has democratized investing, breaking down barriers and empowering individuals to take control of their financial future.

1.2 Changing Trends in Wealth Building

The advent of online investing platforms has also contributed to changing trends in wealth building. Traditionally, wealth building was often associated with property ownership or traditional investment vehicles like stocks and bonds. However, online investing has opened up new avenues for wealth accumulation, such as investing in cryptocurrencies and real estate investment trusts (REITs). These new trends in wealth building offer individuals greater opportunities to diversify their portfolios and potentially achieve higher returns.

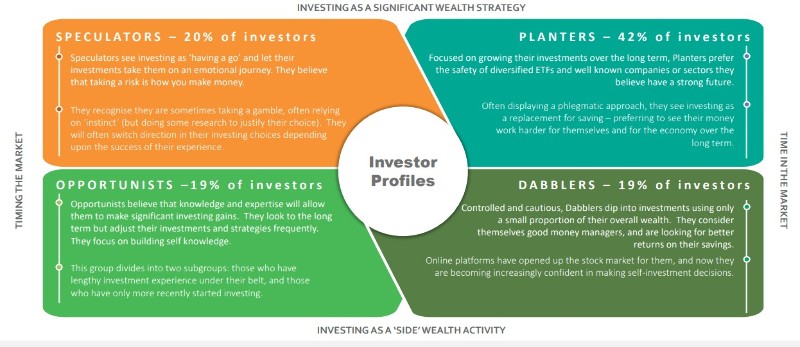

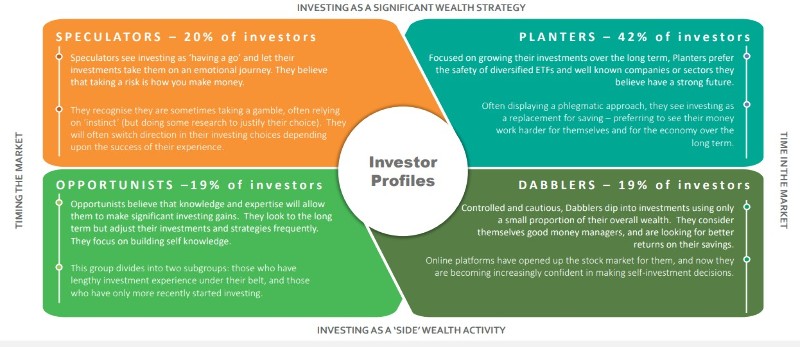

1.3 Opportunities and Challenges in the Online Investing Landscape

While online investing presents numerous opportunities for individuals to grow their wealth, it also comes with its own set of challenges. One of the key challenges is the need for individuals to educate themselves about investment options and navigate the complex world of finance. Additionally, there are risks associated with online investing, such as market volatility, scams, and emotional decision-making. However, with proper knowledge, risk management, and diligence, individuals can overcome these challenges and take full advantage of the opportunities presented by online investing.

2. Advantages of Investing and Wealth Building Online

Investing and wealth building online offer several advantages that make it an attractive option for individuals looking to grow their financial resources.

2.1 Accessibility and Convenience

One of the major advantages of online investing is its accessibility and convenience. With online platforms, you can invest from the comfort of your own home, at any time that suits you. This eliminates the need for face-to-face meetings with brokers or having to visit physical branches of financial institutions. Moreover, online investing platforms usually offer user-friendly interfaces, making it easier for individuals who may not have extensive financial knowledge to start investing.

2.2 Lower Costs and Fees

Online investing platforms often have lower costs and fees compared to traditional brokerage services. Traditional brokers typically charge high commissions and fees for their services, which can eat into your investment returns. On the other hand, online platforms tend to offer lower fees and some even provide commission-free trading options. This means that more of your investment capital can be put to work, increasing your potential for long-term growth.

2.3 Diversification and Portfolio Management

Diversifying your investment portfolio is crucial for managing risk and maximizing returns. Online investing platforms provide a wide range of investment options, allowing you to diversify across various asset classes, sectors, and geographic locations. Furthermore, online platforms often offer portfolio management tools and recommendations to help you build and maintain a diversified portfolio. By having a well-diversified portfolio, you can mitigate the impact of individual investment losses and increase your chances of achieving long-term financial success.

2.4 Real-time Data and Information

Having access to real-time data and information is essential for making informed investment decisions. Online investing platforms provide up-to-date market data, news, and analysis, enabling you to stay informed about the latest developments in the financial markets. This real-time information empowers you to react quickly to market changes and make timely investment decisions. By staying informed, you can take advantage of investment opportunities and proactively manage your portfolio.

2.5 Automation and Robo-Advisors

Automation is another key advantage of online investing. Many online platforms offer automated investment services known as robo-advisors. These robo-advisors use algorithms to create and manage investment portfolios based on your risk tolerance and financial goals. Automating your investments can help remove emotional biases and ensure consistent investment decisions. Robo-advisors also tend to have lower fees compared to traditional financial advisors, making them an attractive option for cost-conscious investors.

3. Online Investment Options

Online investing offers a multitude of investment options to suit different risk tolerances, investment objectives, and time horizons.

3.1 Stocks and ETFs

Stocks and exchange-traded funds (ETFs) are popular investment options for those seeking growth and capital appreciation. Online investing platforms provide access to a wide range of stocks and ETFs, allowing you to invest in individual companies or diversified portfolios representing specific sectors or themes. Investing in stocks and ETFs can be a great way to participate in the growth of the global economy and potentially benefit from capital gains.

3.2 Bonds and Fixed Income

Bonds and fixed income securities are considered more conservative investment options compared to stocks. They provide a fixed stream of income to investors in the form of periodic interest payments. Online investing platforms enable individuals to invest in government bonds, corporate bonds, and other fixed income instruments, making it easier to diversify and balance their investment portfolios.

3.3 Mutual Funds and Index Funds

Mutual funds and index funds are professionally managed investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Online investing platforms offer a wide selection of mutual funds and index funds, allowing investors to gain exposure to a wide range of asset classes and investment strategies. These funds can be a convenient way for individuals to access professional management and achieve diversification in their investment portfolios.

3.4 Cryptocurrencies and Digital Assets

Cryptocurrencies and digital assets have gained significant attention in recent years. Online investing platforms have responded to this growing demand by offering investment options in cryptocurrencies such as Bitcoin and Ethereum. Investing in cryptocurrencies can be highly volatile and involves additional risks, but it also offers the potential for high returns. Online investing platforms provide a convenient and regulated way for individuals to invest in digital assets.

3.5 Real Estate Investment Trusts (REITs)

Investing in real estate has traditionally required significant capital and expertise. However, online investing has made real estate investing more accessible through the use of real estate investment trusts (REITs). REITs allow individuals to invest in a portfolio of income-generating properties without the need to directly own and manage real estate. Online platforms provide a variety of REIT options, catering to different risk appetites and investment objectives.

4. Building Wealth through Online Trading

Building wealth through online trading involves implementing various investment strategies and approaches depending on your investment goals and risk tolerance.

4.1 Day Trading and Swing Trading

Day trading and swing trading are short-term trading strategies that aim to profit from intraday or short-term price movements in the financial markets. Day traders and swing traders often take advantage of technical analysis tools and market volatility to enter and exit positions. While these trading strategies can offer the potential for quick profits, they also require extensive knowledge, time commitment, and the ability to manage risks.

4.2 Long-term Investing Strategies

Long-term investing strategies focus on buying and holding investments for an extended period, typically years or even decades. This approach is commonly associated with investing in solid companies with sustainable business models and long-term growth prospects. Long-term investors often rely on fundamental analysis and take a buy-and-hold approach, allowing their investments to grow steadily over time.

4.3 Social Trading and Copy Trading

Social trading and copy trading have gained popularity in recent years, particularly among novice investors. Social trading platforms allow individuals to follow and copy the trades of successful traders. This approach enables less experienced investors to benefit from the expertise of seasoned traders and potentially achieve successful investment outcomes. However, it is important to exercise caution and conduct thorough research before blindly copying the trades of others.

4.4 Options and Futures Trading

Options and futures trading are advanced trading strategies that involve contracts based on the future price of an underlying asset. These derivatives provide investors with the opportunity to hedge their positions, speculate on price movements, and potentially achieve higher returns. However, options and futures trading can be complex and involve a higher level of risk compared to traditional investments. It is essential to have a solid understanding of derivatives and risk management before engaging in these types of trades.

5. Tips for Successful Online Investing and Wealth Building

While online investing offers numerous opportunities, it is important to approach it with a well-thought-out plan and a focus on long-term success. Here are some tips to help you navigate the online investing landscape successfully:

5.1 Setting Clear Financial Goals

Before you start investing online, it is crucial to define your financial goals. Are you investing for retirement, buying a home, or funding your child’s education? Clearly articulating your goals will help you determine your investment time horizon, risk tolerance, and asset allocation.

5.2 Educating Yourself about Investment Options

Investing requires a basic understanding of different investment options and strategies. Take the time to educate yourself about the fundamentals of investing, including concepts like diversification, risk and return, and asset allocation. Online platforms often provide educational resources, including articles, videos, and webinars, to help you improve your investment knowledge.

5.3 Developing a Diversified Portfolio

Diversification is key to managing risk and maximizing returns. Spread your investments across multiple asset classes, sectors, and geographies to reduce your exposure to any single investment. A diversified portfolio can help mitigate potential losses and increase the likelihood of achieving long-term financial success.

5.4 Regularly Monitoring and Rebalancing

Stay actively involved in managing your investment portfolio. Regularly review your portfolio and monitor its performance. If your investments deviate from your target asset allocation, consider rebalancing your portfolio to realign it with your original investment strategy. Rebalancing involves buying and selling investments to bring your portfolio back in line with your desired asset mix.

5.5 Managing Risk and Emotions

Investing involves taking risks, but it is essential to manage those risks effectively. Avoid making impulsive decisions based on short-term market fluctuations or emotional reactions. Stick to your investment plan, focus on your long-term goals, and avoid making drastic changes to your portfolio based on short-term market movements. Stay disciplined and maintain a long-term perspective.

6. Overcoming Barriers in Online Investing and Wealth Building

While online investing has opened up new possibilities, there are several barriers that individuals may encounter. It is crucial to be aware of these barriers and find ways to overcome them to maximize the benefits of online investing.

6.1 Security and Privacy Concerns

Online investing involves sharing personal and financial information over the internet, which can raise security and privacy concerns. To mitigate these risks, choose reputable and regulated online platforms that prioritize the security of your personal data. Take steps to protect your online accounts, such as using strong passwords, enabling two-factor authentication, and regularly monitoring your account activity.

6.2 Technological Requirements and Infrastructure

Access to reliable internet connectivity and suitable technology devices is essential for online investing. However, not all individuals have equal access to the required technological infrastructure. It is crucial to consider these limitations and seek alternative solutions, such as utilizing public libraries or community centers with internet access, to overcome technological barriers.

6.3 Regulatory Challenges and Compliance

Different countries have varying regulations and compliance requirements for online investing. Ensure that the online platform you choose operates within the legal frameworks and complies with the necessary regulations in your jurisdiction. Be aware of any restrictions or limitations that may impact your ability to invest in certain asset classes or access specific investment products.

6.4 Digital Divide and Accessibility Issues

The digital divide refers to the gap between individuals who have access to technology and the internet and those who do not. This divide can pose challenges for individuals looking to engage in online investing. Efforts are being made to bridge the digital divide, but it is important to be aware of this barrier and seek alternative resources or support to overcome accessibility challenges.

6.5 Lack of Financial Literacy and Education

Financial literacy plays a crucial role in successful investing. Lack of financial literacy and education can limit individuals’ ability to make informed investment decisions and understand the complexities of the financial markets. To overcome this barrier, take advantage of the educational resources provided by online platforms, seek out financial education programs, and consider consulting with a financial advisor to enhance your investment knowledge.

7. The Future of Online Investing and Wealth Building

The future of online investing and wealth building holds exciting possibilities as technology continues to advance. Here are some trends that may shape the future of online investing:

7.1 Artificial Intelligence and Machine Learning

Artificial intelligence and machine learning technologies have the potential to revolutionize investing and wealth management. These technologies can analyze vast amounts of data, identify patterns, and make investment recommendations based on algorithms. As AI and machine learning continue to evolve, they may offer more sophisticated and personalized investment strategies for individuals.

7.2 Virtual Reality and Augmented Reality in Trading

Virtual reality (VR) and augmented reality (AR) technologies have the potential to enhance the trading experience. These technologies can provide immersive environments for traders to visualize market data, analyze charts, and execute trades. Virtual trading floors and simulated investment environments may become more prevalent, enabling traders to gain hands-on experience and refine their skills.

7.3 Blockchain and Decentralized Finance (DeFi)

Blockchain technology has disrupted various industries, and its impact on the financial sector is expected to grow. Decentralized finance (DeFi) platforms built on blockchain technology provide individuals with new opportunities for online investing and wealth building. DeFi platforms allow for peer-to-peer lending, automated market-making, and other decentralized financial services, bypassing traditional intermediaries.

7.4 Social Impact Investing and Sustainability

There is a growing interest in social impact investing and sustainability. Individuals are increasingly seeking to align their investments with their values, investing in companies and funds that promote positive social and environmental impact. Online investing platforms may further develop tools and features to support social impact investing and empower individuals to invest in companies that align with their values.

7.5 Global Connectivity and Cross-border Investing

Online investing has removed geographical barriers, allowing individuals to invest in markets around the world. The future of online investing may see greater global connectivity, enabling investors to access and invest in markets beyond their home countries. This trend may present new opportunities for diversification and access to emerging markets.

8. Case Studies: Online Investment Success Stories

Online investing has empowered individuals from all walks of life to achieve financial success. Here are some case studies that exemplify the benefits of investing and wealth building online:

8.1 From Rags to Riches: How Online Investing Changed Lives

Online investing has provided opportunities for individuals to transform their financial situations. Many success stories highlight individuals who started with limited resources and, through savvy online investing strategies, were able to build substantial wealth.

8.2 Millennial Millionaires: Young Investors Making Waves

The rise of online investing has seen a surge in millennial investors achieving financial success at a young age. Tech-savvy millennials have embraced online platforms and leveraged digital tools to build impressive investment portfolios. These success stories demonstrate the power of online investing for the younger generation.

8.3 Retire Early: Financial Independence through Online Wealth Building

Online investing has played a significant role in enabling individuals to achieve financial independence and retire early. By focusing on long-term strategies and diligently saving and investing, individuals have built substantial wealth and gained the financial freedom to retire at a young age.

8.4 Women in Investing: Breaking Gender Barriers

Online investing has provided women with an equal opportunity to participate in the financial markets and build wealth. Many success stories highlight women who have overcome gender barriers to achieve financial success through online investing. These stories encourage more women to take control of their financial futures.

8.5 Small Investors, Big Returns: Strategies for the Average Investor

Online investing has leveled the playing field for small investors. Many success stories highlight average individuals who have achieved significant returns by leveraging online investing platforms and implementing sound investment strategies. These stories demonstrate that anyone, regardless of their financial resources, can achieve success through online investing.

9. Risks and Pitfalls of Online Investing

While online investing offers numerous advantages, it is important to be aware of the potential risks and pitfalls associated with this approach. Here are some key risks to consider:

9.1 Market Volatility and Economic Uncertainty

The financial markets are subject to volatility and economic uncertainty. Market downturns can result in significant losses for investors. It is essential to understand that investing involves risks and the value of investments can fluctuate. Having a long-term investment perspective and diversifying your portfolio can help mitigate these risks.

9.2 Online Scams and Fraudulent Schemes

The rise of online investing has also led to an increase in online scams and fraudulent schemes. Individuals should be cautious and perform due diligence before investing funds with unfamiliar platforms or individuals promising high returns. Stick to reputable and regulated online platforms and be vigilant of potential scams.

9.3 Overtrading and Greed

Online investing platforms provide individuals with easy access to the financial markets, which can lead to overtrading and excessive risk-taking. It is important to develop a disciplined approach to investing, avoid succumbing to the lure of quick profits, and resist making impulsive trading decisions driven by greed.

9.4 Lack of Personalized Advice

While online investing platforms offer a wealth of information and resources, they may not provide personalized advice tailored to your specific financial situation and goals. Consider consulting with a financial advisor who can provide tailored guidance and help you navigate the complexities of investing.

9.5 Behavioral Biases and Emotional Decision Making

Investing is not solely driven by rational analysis but also by human emotions and behavioral biases. Emotional decision-making can lead to poor investment choices, such as panic selling during market downturns or chasing after hot investment trends. Being aware of these biases and having a disciplined investment approach can help mitigate these risks.

10. Conclusion

Investing and wealth building online have brought about a transformative shift in the financial landscape. Online platforms have made investing more accessible, convenient, and cost-effective for individuals from all walks of life. With advancements in technology, the opportunities for online investing continue to expand, offering individuals a wide range of investment options and strategies.

However, it is important to approach online investing with caution and diligence. Educate yourself about different investment options, set clear financial goals, and develop a well-diversified portfolio. Regularly monitor and adjust your investments as needed but avoid making impulsive decisions driven by short-term market fluctuations.

Online investing is not without its risks and challenges, such as market volatility, scams, and emotional decision-making. It is important to be aware of these risks and take steps to mitigate them. Conduct thorough research, choose reputable online platforms, and seek professional advice when needed.

The future of online investing holds exciting possibilities, including advancements in artificial intelligence, virtual reality, and blockchain technology. These developments may further enhance the investment experience and provide individuals with even more opportunities to grow their wealth.

Ultimately, online investing has the potential to empower individuals to take control of their financial future and achieve their long-term financial goals. By embracing the benefits of online investing while being mindful of the risks, you can set yourself on a path towards financial success.