Imagine being able to build wealth from the comfort of your own home, without the hassle of traditional investing methods. With the advancements in technology, investing and wealth building online have never been easier or more accessible. In this article, we will explore the numerous benefits of online investing and how it can help you achieve your financial goals in 2023 and beyond. Whether you’re a seasoned investor or just starting out, online investing offers a world of opportunities that can help you grow your wealth and secure a brighter future. So, get ready to unlock the power of online investing and take control of your financial destiny.

Easier Access to Investment Opportunities

Virtual Accessibility

With online investing, you have the convenience of accessing investment opportunities right from the comfort of your own home. No longer do you need to physically visit a financial institution or meet with a broker. Instead, you can simply log in to your online investment account and explore a wide range of investment options at your fingertips. The virtual accessibility of online investing eliminates geographical barriers and allows you to explore and capitalize on global investment opportunities.

Diverse Investment Options

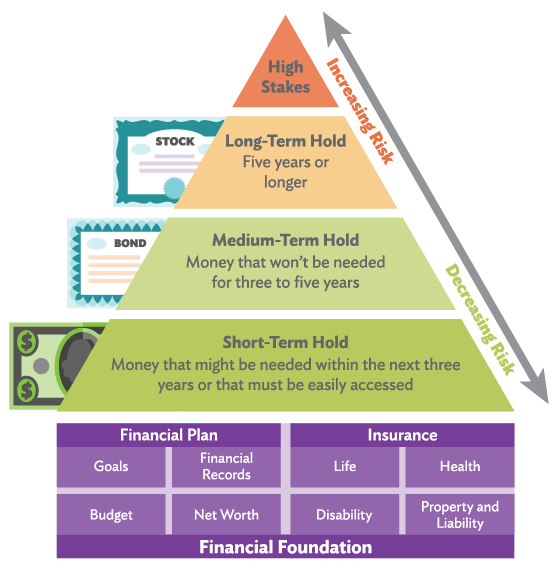

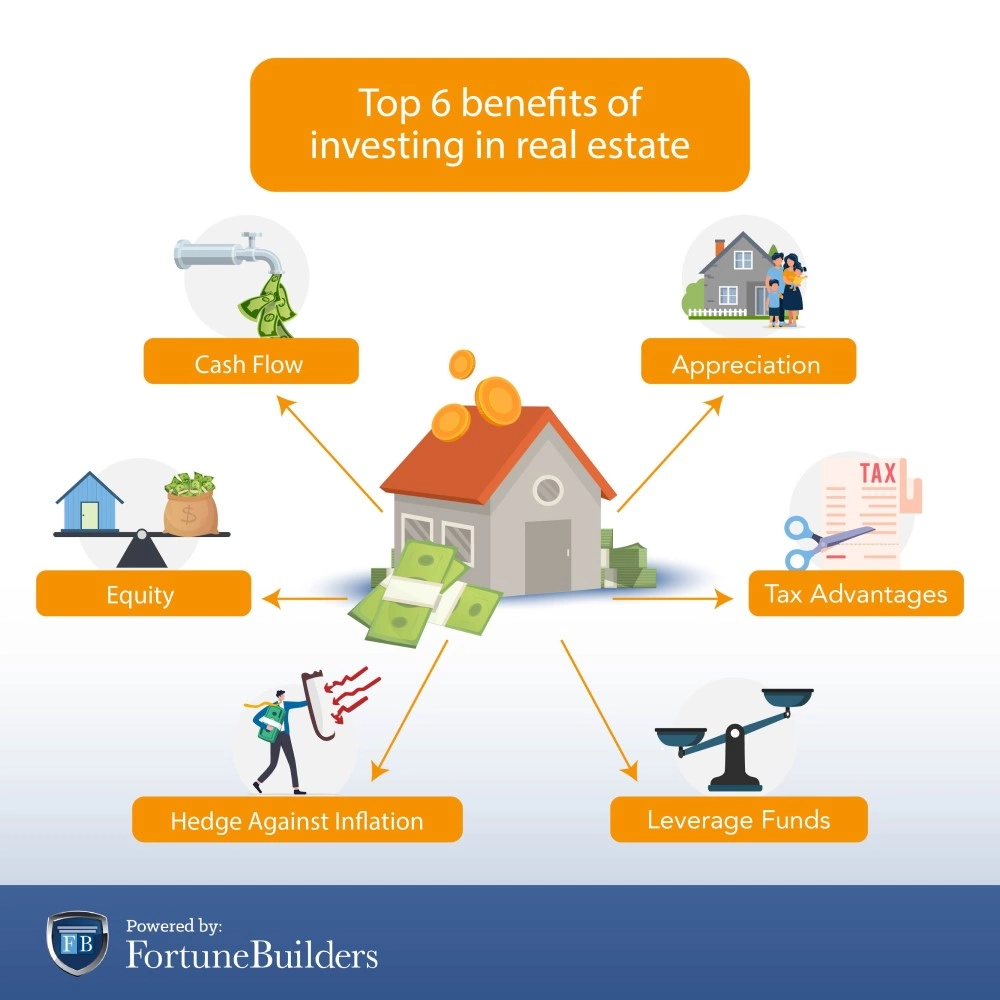

One of the great advantages of online investing is the diverse range of investment options available to you. Whether you are interested in stocks, bonds, mutual funds, or alternative investments, online investment platforms offer a plethora of choices to suit your investment goals and risk tolerance. Moreover, these platforms often provide access to international markets and niche investment opportunities, making it easier for you to diversify your portfolio and potentially enhance your returns.

Lower Minimum Investment Requirements

Historically, traditional investment avenues were often out of reach for small investors due to high minimum investment requirements. However, online investing has significantly lowered these barriers, allowing individuals with limited capital to enter the investment world. Many online investment platforms offer the option to start with low minimum investments, making it possible for you to get started with your wealth-building journey even with a modest amount of money. This lower entry point allows for greater inclusivity and democratization of wealth building.

Convenience and Flexibility

24/7 Availability

Online investing offers the convenience of 24/7 availability, empowering you to manage your investments on your own terms and schedule. Whether you’re an early riser, a night owl, or have a busy schedule, you can access your online investment account at any time and make investment decisions at your own convenience. This flexibility eliminates the need for appointments or waiting for business hours, giving you greater control over your investment journey.

Flexible Investment Strategies

Unlike traditional investment methods that often require a long-term commitment, online investing provides the flexibility to adopt diverse investment strategies. Whether you prefer a buy-and-hold strategy, day trading, or a more active approach, online investment platforms cater to a wide range of investment styles. You can easily adjust your investment strategy based on market conditions, economic trends, or your evolving financial goals without the limitations imposed by traditional investment avenues.

Control and Autonomy

Online investing empowers you with unprecedented control and autonomy over your investment decisions. Rather than relying on the advice or recommendations of a financial advisor, you can conduct your own research, analyze market trends, and make informed investment choices. This level of control allows you to align your investment strategy with your personal beliefs, risk tolerance, and financial objectives. You have the freedom to build and manage your own investment portfolio, taking into account your individual circumstances and preferences.

Lower Costs and Fees

Reduced Commissions

One significant advantage of online investing is the reduction in commissions and transaction costs typically associated with traditional brokers. Online investment platforms often offer significantly lower trading fees, making it more cost-effective to buy and sell investments. This reduction in commissions allows you to maximize your investment returns and allocate a larger portion of your capital towards building wealth, rather than paying high fees.

Lower Account Maintenance Fees

Another cost-saving benefit of online investing is the lower account maintenance fees compared to traditional investment options. Traditional investment accounts often come with significant annual fees, management fees, or minimum balance requirements. In contrast, many online investment platforms offer low or no account maintenance fees, ensuring that more of your money remains invested and working for you.

No Middlemen or Brokers

By investing online, you can eliminate the need for intermediaries such as brokers or financial advisors. This direct-to-consumer approach cuts out the middlemen, reducing transaction costs and management fees that would typically be incurred when working with a traditional financial institution. Online investing allows you to take charge of your investment decisions without the added expense of paying for professional services.

Greater Control and Transparency

Real-Time Monitoring

Online investment platforms provide real-time monitoring tools that enable you to track the performance and progress of your investments in real-time. With just a few clicks, you can access up-to-date information on your portfolio’s value, individual investment holdings, and performance metrics. This real-time monitoring empowers you to make timely decisions based on accurate and current information, ensuring that you remain in control of your investment strategy.

Access to Historical Data

In addition to real-time monitoring, online investing platforms give you access to historical data and performance records. This data allows you to analyze past trends, evaluate investment performance, and make informed decisions based on historical patterns. By studying the historical data, you can identify potential investment opportunities, assess the risks, and adjust your strategy accordingly, all with the aim of enhancing your wealth-building efforts.

Instantaneous Trades

Gone are the days of calling up a broker and waiting for trade execution. Online investing provides the convenience of instantaneous trades. With just a few clicks, you can buy or sell investments in real-time, capitalizing on market opportunities without delay. This efficiency and speed of trade execution give you a competitive advantage, allowing you to take advantage of favorable market conditions or respond quickly to changing circumstances, all while maintaining control over your investment decisions.

Efficiency and Speed

Quick Execution of Trades

Online investing offers the advantage of quick execution of trades. When investing online, you can place orders to buy or sell investments instantly, reducing the time lag between decision-making and trade execution. This efficiency ensures that your investment transactions are executed promptly, minimizing the risks associated with delayed trades and allowing you to capitalize on favorable market conditions.

Automated Portfolio Management

Online investment platforms often provide automated portfolio management tools, streamlining the process of managing your investments. Through features such as automatic rebalancing or dividend reinvestment, you can ensure that your portfolio remains aligned with your desired asset allocation and risk tolerance. Automation eliminates the need for constant manual adjustments, saving you time and effort, while maintaining the desired diversification and optimizing your portfolio’s performance.

Effortless Diversification

Diversification is a key strategy for managing risk in investment portfolios. Online investing simplifies the process of diversification by offering a wide range of investment options within a single platform. With just a few clicks, you can allocate your capital across different asset classes, sectors, or geographical regions, enhancing the diversification of your portfolio. This effortless diversification reduces the concentration risk associated with investing in a single investment or asset class, potentially mitigating losses and smoothing out your overall investment returns.

Educational Resources and Analytical Tools

Online Investment Courses

Online investment platforms often provide educational resources, including investment courses, to help you enhance your investment knowledge and skills. These courses cover various topics, from investment basics to advanced strategies, and can be accessed at your own pace and convenience. By taking advantage of online investment courses, you can deepen your understanding of investment concepts, stay updated with market trends, and make more informed investment decisions.

Interactive Webinars and Seminars

In addition to educational courses, online investment platforms frequently host interactive webinars and seminars conducted by industry experts. These live sessions offer the opportunity to learn from experienced professionals, ask questions, and engage in discussions with fellow investors. Interactive webinars and seminars can provide valuable insights, market perspectives, and practical advice, helping you stay informed and making your investment journey more dynamic and fulfilling.

Advanced Analytical Tools

Online investing platforms often provide sophisticated analytical tools to aid in investment decision-making. These tools offer in-depth market analysis, portfolio performance tracking, and risk assessment, among other features. By utilizing these advanced analytical tools, you can conduct comprehensive research, identify market trends, and gain insights into the performance of your investments. Armed with this information, you can make data-driven investment decisions, potentially improving the outcomes of your portfolio.

Risk Mitigation and Increased Security

Strict Security Measures

Online investment platforms take security seriously and implement strict measures to protect your personal and financial information. These platforms utilize robust encryption protocols, firewalls, and multi-factor authentication to safeguard your data. Additionally, reputable online investment platforms are regulated by financial authorities, providing an additional layer of security and ensuring compliance with industry standards. By investing online, you can have peace of mind knowing that your investments and personal data are safeguarded with industry-leading security measures.

Enhanced Account Protection

In the digital realm, online investing platforms incorporate various security features to protect your investment accounts. Two-factor authentication, secure login protocols, and account activity monitoring are among the security measures in place to prevent unauthorized access to your accounts. Furthermore, online investment platforms often have dedicated customer service teams ready to assist you with any security concerns or suspicious activities, providing an added level of protection for your investments.

Risk Management Tools

Online investing platforms offer risk management tools to help you navigate the uncertainties of the market. These tools include stop-loss orders, limit orders, and risk assessment questionnaires, among others. By utilizing these risk management tools, you can set predetermined thresholds for losses, automate trade executions at specific price points, and assess your risk profile to align your investment strategy accordingly. This proactive approach to risk management helps mitigate potential losses and ensures that you maintain control over your investment risk.

Portfolio Customization and Adaptability

Tailored Investment Strategies

Online investing allows for tailored investment strategies that align with your specific investment goals and preferences. Whether you prioritize growth, income, or a combination of both, online investment platforms provide customizable options to tailor your investment strategy accordingly. You can select from a wide range of investment products, adjust risk levels, and set investment preferences based on your financial objectives. This customization ensures that your investment strategy is personalized to your needs and evolves with your changing circumstances.

Flexible Portfolio Adjustments

As your financial situation or investment goals change, online investing offers the flexibility to adjust your investment portfolio accordingly. With just a few clicks, you can rebalance your portfolio, reallocate assets, or make other adjustments to ensure it remains in line with your desired risk profile and investment objectives. This adaptability enables you to respond to changing market conditions or life events without the constraints imposed by traditional investment avenues, allowing you to optimize your portfolio’s performance and adapt to evolving market trends.

Incorporating Social and ESG Factors

Online investment platforms often provide options to invest in companies or funds that align with your values and support environmental, social, and governance (ESG) factors. Through socially responsible investing or impact investing options, you can choose investments that reflect your commitment to sustainability, social justice, or other causes you believe in. This customization allows you to have a positive impact through your investments while working towards your financial goals, creating a win-win situation that aligns your principles with your investment strategy.

Greater Market Insights and Research

Access to In-Depth Market Analysis

Online investing platforms offer access to robust market analysis tools, research reports, and expert insights. These resources can help you gain a deeper understanding of the market dynamics, industry trends, and economic factors influencing your investments. With access to in-depth market analysis, you can make more informed investment decisions, enhance your portfolio’s performance, and stay informed about potential risks or opportunities that may arise in the market.

Real-Time News and Updates

Staying up to date with the latest news and updates is crucial for effective investment decision-making. Online investing platforms provide real-time news feeds and market updates, keeping you informed about important events, economic indicators, and breaking news that may affect your investments. By having access to real-time information, you can react promptly to market developments, capitalize on emerging trends, and adjust your investment strategy accordingly.

Data-Driven Investment Decisions

Online investment platforms enable you to make data-driven investment decisions by providing a wealth of research data and performance metrics. Through charts, graphs, historical data, and financial statements, you can analyze the performance, valuation, and growth prospects of potential investments. This data-driven approach helps minimize emotional bias and ensures that your investment decisions are grounded in a thorough analysis of the facts and figures. By relying on data rather than emotions, you can make more rational and objective investment decisions, potentially enhancing your portfolio’s performance.

Improved Portfolio Performance Measurement

Detailed Performance Reports

Online investing offers detailed performance reports that provide insights into the performance of your investment portfolio. These reports typically include metrics such as return on investment, portfolio allocation, and performance attribution. By reviewing these reports, you can assess the effectiveness of your investment strategy, identify areas for improvement, and make informed decisions to optimize your portfolio’s performance. Detailed performance reports help you track your progress towards your investment goals and provide a clear picture of your portfolio’s strengths and weaknesses.

Comparative Analysis

Online investment platforms often provide tools to compare the performance of your investments against relevant benchmarks or peer portfolios. Through comparative analysis, you can evaluate how your investments stack up against similar investments or market indices. This analysis allows you to identify underperforming investments, pinpoint areas of strength, and make adjustments to enhance the overall performance of your portfolio. Comparative analysis provides valuable insights into the relative performance of your investments, enabling you to make informed decisions based on objective data.

Track Record Evaluation

By investing online, you have access to comprehensive track records and historical performance data for various investment options. This information allows you to evaluate the track record and performance of investment products or fund managers before making investment decisions. By reviewing the track record, you can assess the consistency, risk-adjusted returns, and potential long-term performance of the investments you are considering. Track record evaluation helps you make more informed investment choices, potentially boosting your portfolio’s performance and increasing the likelihood of achieving your wealth-building goals.

In conclusion, online investing offers a wealth of benefits that make it an attractive option for wealth building. From easier access to investment opportunities and enhanced convenience to lower costs, greater control, and increased transparency, online investing empowers you to take charge of your financial future. With the convenience of virtual accessibility, 24/7 availability, and flexible investment strategies, online investing provides the tools you need to build and manage your wealth. Furthermore, the availability of educational resources, risk mitigation tools, and improved portfolio performance measurement contribute to your success as an online investor. So take advantage of the benefits of online investing and embark on your journey towards wealth building with confidence and autonomy.