So, you’re facing a big life event on the horizon, whether it’s a wedding, buying a house, or starting a family. It’s an exciting time, filled with anticipation and joy. However, amidst all the excitement, you’re also feeling the weight of financial responsibility. How do you manage to budget for these big life events and still save money? Well, fear not, because in this article, we’ve got you covered. We’ll provide you with practical tips and strategies to help you navigate the financial aspects of these milestones, ensuring that you can enjoy the journey without breaking the bank.

Key Steps to Budgeting for Big Life Events

Identify the Upcoming Life Event

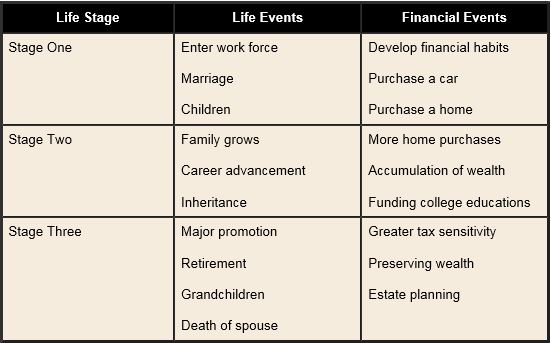

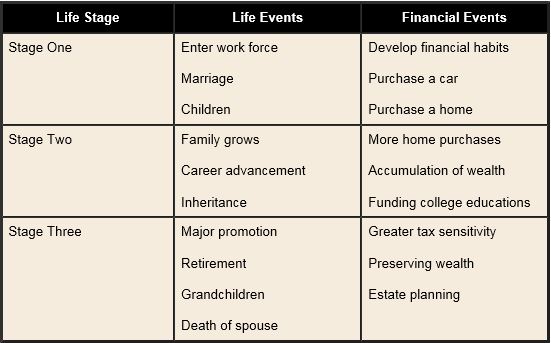

When it comes to budgeting for big life events, the first step is to identify the event itself. Whether it’s a wedding, buying a house, starting a family, or planning for retirement, understanding the nature and scope of the event is crucial. Take the time to determine the timeline and deadline for when you want to achieve this goal. Consider the importance and impact it will have on your life and financial future. Evaluating your financial priorities will help you set realistic expectations and prioritize your spending accordingly.

Start Planning Early

Once you’ve identified the upcoming life event, it’s essential to give yourself sufficient time to plan. Starting early gives you the advantage of researching and gathering information about the event, including potential funding options. Whether it’s saving for a down payment on a house or budgeting for a dream vacation, early planning allows you to explore various avenues for funding and make informed decisions. If necessary, don’t hesitate to seek expert advice from financial planners or professionals in the field to help you create a comprehensive plan.

Assess Your Current Financial Situation

Before diving into the specifics of budgeting for the event, you need to assess your current financial situation. Review your income and expenses to understand how much money you have available to allocate towards your goal. Analyze your debt and savings to determine if there are areas for improvement. It’s also essential to identify any potential risks or emergencies that may impact your financial stability. This evaluation allows you to have a clear understanding of your current financial standing and make informed decisions about how much you can save and allocate towards the event.

Estimate the Cost of the Event

To create an effective budget, you need to estimate the total cost of the event. Take the time to break down the event into different categories such as venue, food, transportation, clothing, and other related expenses. Research and gather cost estimates for each category to get an accurate idea of how much the event will cost. Additionally, remember to factor in any potential additional expenses that may arise in the planning process. It’s also prudent to include contingency funds to account for unexpected costs that may arise along the way.

Determine Your Savings Goal

Once you have estimated the cost of the event, you need to determine your savings goal. Calculate the total amount needed for the event, including all categories and contingency funds. Setting a realistic savings deadline is crucial, as it will help you stay on track and monitor your progress. Consider your monthly saving capacity and break down the goal into achievable steps. By establishing a clear savings goal, you can work towards it with purpose and motivation.

Create a Realistic Budget

With your savings goal in mind, it’s time to create a realistic budget. Start by listing your regular monthly income, including any fixed salaries or sources of revenue. Next, track your essential expenses, such as rent, utilities, groceries, and transportation. Allocate funds for savings, ensuring that you set aside a specific amount each month to reach your savings goal. Finally, allocate funds for event-related expenses, taking into account the cost estimates you gathered earlier. It’s important to prioritize your spending, ensuring that you allocate enough towards the event while still meeting your regular financial obligations. Leave room for flexibility within your budget to account for any unexpected expenses that may arise. Consider the impact on your long-term goals as well, ensuring that the event budget aligns with your overall financial plan.

Cut Back on Discretionary Spending

When budgeting for a big life event, it’s crucial to identify non-essential expenses and find areas to cut back on discretionary spending. Adopt cost-saving measures such as reducing or eliminating subscription services, limiting dining out and entertainment expenses, and shopping smart to take advantage of deals and discounts. By consciously reducing discretionary spending, you can allocate more funds towards your savings goal and stay on track with your budget.

Explore Additional Income Sources

To boost your savings and meet your savings goal faster, consider exploring additional income sources. Look for opportunities to earn extra income, whether through part-time or freelance work. Leverage your skills and hobbies to generate revenue or explore online platforms and the gig economy for income-generating opportunities. Additionally, you can monetize assets or unused items by selling them, providing an additional source of funds for your budget.

Consider Temporary Lifestyle Changes

Sometimes, meeting your savings goal requires making temporary lifestyle changes. Assess your current lifestyle and identify areas where you can make adjustments to save money. This can include cutting back on vacations, dining out less frequently, or downsizing certain expenses temporarily. While these changes may require some sacrifices, they can significantly contribute to achieving your savings goal for the big life event.

Monitor and Adjust Your Budget

Creating a budget is not a one-time task; it requires ongoing monitoring and adjustments. Regularly track your expenses and compare them to the budgeted amounts to identify areas of overspending or underspending. If necessary, make necessary adjustments to ensure you stay within your financial plan. It’s important to stay disciplined and committed to your budget, making tweaks as needed along the way. By monitoring and adjusting your budget as necessary, you can be confident in your ability to reach your savings goal for the big life event.

In conclusion, budgeting for big life events requires careful planning, assessment of your financial situation, and a realistic understanding of the cost and savings goals involved. By following these key steps and taking control of your finances, you can ensure that you’re prepared for the event and can enjoy it without unnecessary financial stress. Remember to start planning early, consider potential funding options, and make temporary lifestyle changes if needed. With diligent monitoring and adjustments along the way, you can successfully budget for any big life event and still save for your future.