Looking to expand your financial portfolio and build wealth? Look no further than the world of online investing. With the vast array of opportunities available, investing and wealth building online have become increasingly popular in recent years. Whether you’re an experienced investor or just starting out, this article will explore the various opportunities and strategies that can help you make the most of your online investments, paving the way for a prosperous future.

Exploring Opportunities for Investing and Wealth Building Online

Overview of Investing and Wealth Building Online

When it comes to building wealth and securing your financial future, the internet has opened up a whole world of opportunities. Online investing and wealth building have become increasingly popular, allowing individuals to access a wide range of investment options and strategies from the comfort of their homes. Whether you’re a seasoned investor or just starting out, exploring the online landscape can provide you with exciting avenues to grow your wealth.

Types of Online Investments

- Stock Market Investments

Investing in the stock market has long been a popular way to grow wealth, and the internet has made it easier than ever. Online brokerage platforms provide individuals with access to a vast array of stocks and investment products. With a click of a button, you can buy and sell stocks, track your portfolio, and execute trades in real-time. The stock market offers the potential for significant returns but also comes with risks, so it’s essential to do thorough research and stay informed.

- Real Estate Investments

Real estate has always been a tangible and lucrative investment, but it no longer requires large amounts of capital or extensive knowledge of the market. Online platforms now allow you to invest in real estate crowdfunding or purchase shares in real estate investment trusts (REITs). These platforms give you access to a diverse range of properties, both residential and commercial, allowing you to earn passive income and enjoy the potential appreciation of your investment.

- Peer-to-Peer Lending

Peer-to-peer lending platforms have disrupted the traditional banking system by connecting borrowers directly with lenders. As an investor, you can lend money to individuals or small businesses in need, earning interest on your investment. P2P lending offers higher returns compared to traditional savings accounts or bonds, but it’s important to evaluate the creditworthiness of borrowers before lending your money.

- Cryptocurrency and Blockchain Investments

Cryptocurrencies, such as Bitcoin and Ethereum, have taken the financial world by storm in recent years. These digital currencies operate on blockchain technology, offering potential for high returns but also significant volatility. Online cryptocurrency exchanges allow you to buy and sell cryptocurrencies, and you can also invest in blockchain-based projects through Initial Coin Offerings (ICOs). It’s crucial to do thorough research and understand the risks involved before venturing into this market.

- Crowdfunding

Crowdfunding platforms have revolutionized the way entrepreneurs and startups raise capital. As an investor, you can participate in crowdfunding campaigns and support innovative projects in various industries. Whether it’s backing a new tech gadget, a creative project, or a social enterprise, crowdfunding allows you to invest in ideas that align with your interests and values.

Pros and Cons of Online Investing

- Pros of Online Investing

Online investing offers several advantages. First and foremost, it provides convenience and accessibility, allowing you to manage your investments anytime, anywhere. You have greater control over your portfolio, with the ability to make informed decisions based on real-time data. Online platforms also provide access to a wide range of investment options, helping you diversify your portfolio and potentially maximize returns. Additionally, the lower transaction costs associated with online investing compared to traditional brokers can increase your overall profitability.

- Cons of Online Investing

While online investing has many benefits, it’s essential to consider the drawbacks as well. Online platforms may lack the personalized advice and guidance of a traditional financial advisor, making it crucial for you to do extensive research and make informed decisions independently. The risk of fraud and cyberattacks is also a concern in the online environment, so it’s imperative to choose reputable platforms and prioritize security measures. Finally, the online investing landscape can be overwhelming for beginners, so it’s vital to start slow, seek education, and gradually increase your investment knowledge.

Strategies for Successful Online Investing

- Set Clear Goals

Before you start investing online, it’s essential to define your financial goals. Are you investing for retirement, a down payment on a house, or to fund your passion projects? Having clear goals will help you determine the appropriate investment strategy and time horizon.

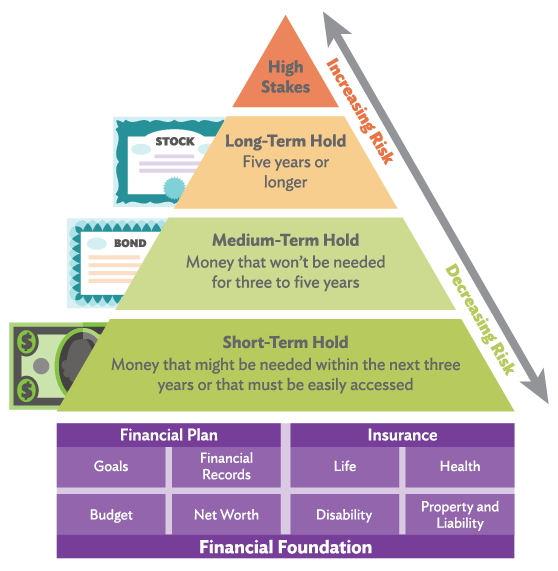

- Diversify Your Portfolio

Diversification is the key to mitigating risk and maximizing potential returns. Allocate your investments across different asset classes and industries to ensure that potential losses in one area can be offset by gains in another.

- Research and Analyze

Knowledge is power in the world of investing. Take the time to research and analyze the investment options available to you. Consider factors such as historical performance, industry trends, and the underlying fundamentals of the investments.

- Stay Updated with Market Trends

The financial landscape is constantly evolving, and online investors need to stay informed. Keep an eye on market trends, economic indicators, and news that may affect your investments. Subscribe to reliable financial publications and follow reputable financial websites or social media accounts to stay up-to-date.

- Manage Risk and Emotions

Investing involves risk, and it’s important to have a risk management strategy in place. Develop an understanding of your risk tolerance and set appropriate stop-loss orders or take-profit levels. Additionally, keep emotions in check and avoid making impulsive investment decisions based on market fluctuations.

Wealth Building through Online Business Ventures

- E-commerce and Dropshipping

Running an e-commerce business allows you to leverage the power of the internet to sell products and generate income. Dropshipping, in particular, eliminates the need for holding inventory, as the products are shipped directly from the supplier to the customer. With the right product selection and effective marketing strategies, you can build a profitable e-commerce business from scratch.

- Affiliate Marketing

Affiliate marketing involves promoting other people’s products or services and earning a commission for each successful referral. By leveraging your online presence, whether through a blog, social media, or email marketing, you can generate passive income by recommending products or services to your audience.

- Online Courses and Information Products

If you have expertise in a particular field, you can create and sell online courses or information products. Platforms like Udemy and Teachable provide the infrastructure to host and sell your courses, allowing you to reach a global audience and monetize your knowledge.

- Digital Real Estate

Just like physical real estate, digital real estate refers to valuable online properties such as websites or online businesses. Investing in digital real estate involves acquiring existing websites or creating your own and monetizing them through advertising, sponsored content, or affiliate marketing.

- Freelancing and Online Services

The gig economy has thrived in the online world, providing opportunities for freelancers to offer their skills and services. Whether you’re a writer, graphic designer, programmer, or virtual assistant, you can find clients and build a successful freelancing career online.

Tips for Building Wealth Online

- Find a Profitable Niche

Identify a niche market that has high demand but low competition. By catering specifically to the needs and desires of a targeted audience, you can position yourself as an expert and differentiate your business from competitors.

- Build a Strong Brand and Online Presence

Invest in creating a strong brand that resonates with your target audience. Develop a professional website, optimize your social media profiles, and consistently produce valuable content to establish your expertise and build trust.

- Offer Value and Provide Excellent Customer Service

In the online business world, providing value to your customers is essential. Offer high-quality products or services that solve their problems or fulfill their desires. Additionally, prioritize exceptional customer service to build strong relationships and encourage repeat business.

- Invest in Marketing and Advertising

To effectively grow your online business, you’ll need to invest in marketing and advertising strategies. Utilize digital marketing channels such as social media ads, content marketing, search engine optimization, and email campaigns to reach your target audience and generate leads.

- Continuously Learn and Adapt

The digital landscape is ever-changing, so it’s crucial to stay updated with the latest trends and technologies. Invest in your personal development by attending online courses, joining relevant communities, and networking with industry professionals. Adapt your strategies as needed to stay ahead of the competition.

The Role of Technology in Online Investing and Wealth Building

- Robo-Advisors and Automated Investments

Robo-advisors are online platforms that use algorithms to provide investment advice and manage portfolios automatically. These platforms offer a convenient and cost-effective way to invest, particularly for beginners or those with limited time.

- Artificial Intelligence and Machine Learning

Artificial intelligence and machine learning are revolutionizing the world of investing. These technologies can analyze vast amounts of data and make data-driven investment decisions. AI-powered trading platforms can identify patterns, predict market movements, and execute trades with high accuracy.

- Big Data Analytics

Big data analytics allows investors to make informed decisions based on large sets of data. By analyzing market trends, consumer behavior, and economic indicators, investors can gain valuable insights to guide their investment strategies.

- Mobile Apps and Digital Platforms

Mobile apps and digital platforms provide investors with instant access to their portfolios, real-time market data, and trading capabilities. These tools enable investors to stay connected and make quick decisions on the go.

Factors to Consider when Choosing an Online Investment Platform

- Security and Privacy

When investing online, security should be a top priority. Ensure that the platform you choose has robust security measures in place, such as two-factor authentication and encryption, to protect your personal and financial information.

- User-Friendliness and Accessibility

Choose an online investment platform that is user-friendly and easy to navigate. It should provide a seamless user experience, with intuitive interfaces and clear instructions. Accessibility across different devices and operating systems is also essential.

- Range of Investment Options

Consider the investment options available on the platform. A diverse range of investment products, such as stocks, bonds, ETFs, and mutual funds, will allow you to build a well-balanced and diversified portfolio.

- Fees and Costs

Be aware of the fees and costs associated with using the platform. Look for transparent pricing structures, including account maintenance fees, trading commissions, and any additional charges for specific services.

- Customer Support and Educational Resources

Evaluate the level of customer support offered by the platform. Access to knowledgeable customer support representatives and educational resources, such as tutorials or investment guides, can help you navigate the platform and make informed investment decisions.

Conclusion

Investing and wealth building online offer exciting opportunities for individuals to grow their financial portfolios and achieve long-term financial goals. Whether you choose to invest in the stock market, real estate, cryptocurrencies, or explore online business ventures, it’s essential to approach these opportunities with a strategic mindset, thorough research, and an understanding of the risks involved. With the right knowledge, tools, and platforms, you can leverage the power of the internet to create wealth and secure your financial future.