In today’s fast-paced digital world, the power to take control of your financial future lies at your fingertips. With the rise of online investing and wealth building, you now have the ability to shape your financial destiny from the comfort of your own home. Gone are the days of relying solely on traditional financial institutions or brokers – now, you can be your own financial expert. Whether you’re a seasoned investor or just starting out, the opportunities for growth and success are endless. In this article, we will explore the exciting world of online investing and wealth building, and how it can empower you to achieve your financial goals in 2023 and beyond.

Understanding Online Investing

The Basics of Online Investing

Online investing refers to the process of using digital platforms and tools to buy and sell financial assets such as stocks, bonds, mutual funds, and real estate investment trusts (REITs). It provides individuals with the opportunity to participate in the financial markets and grow their wealth from the comfort of their own homes. Online investing has become increasingly popular in recent years due to its convenience, accessibility, and potential for high returns.

Benefits of Online Investing

There are a number of benefits associated with online investing. First and foremost, it offers a level of convenience that traditional investing methods cannot match. With just a few clicks, you can access your investment accounts, research potential opportunities, and execute trades, all from your computer or smartphone. Online investing also provides individuals with greater control over their investments, allowing them to make informed decisions based on their own research and analysis. Additionally, online investing often comes with lower fees and expenses compared to traditional brokerages, which can significantly enhance investment returns over the long term.

Risks and Challenges of Online Investing

While online investing offers numerous advantages, it’s important to be aware of the risks and challenges it entails. One of the key risks lies in the volatility of the financial markets. Prices can fluctuate rapidly, and investors can experience both significant gains and losses. Moreover, online investing requires a certain level of financial literacy and knowledge of the investment products and strategies. Without proper understanding, investors may make poor decisions or fall victim to scams or fraudulent schemes. It’s crucial to conduct thorough research, seek advice from professionals, and continually educate yourself to navigate these risks and challenges successfully.

Choosing the Right Online Investment Platform

Researching Different Platforms

When choosing an online investment platform, it’s essential to conduct thorough research to ensure you select the right one for your needs. Start by comparing the features and services offered by different platforms. Look for platforms that are reputable, have a user-friendly interface, and provide access to a wide range of investment options. Read reviews from other users to gain insights into their experiences and satisfaction with the platform. Consider the platform’s security measures, customer support, and ease of use to determine if it aligns with your investment goals and preferences.

Considerations When Selecting an Investment Platform

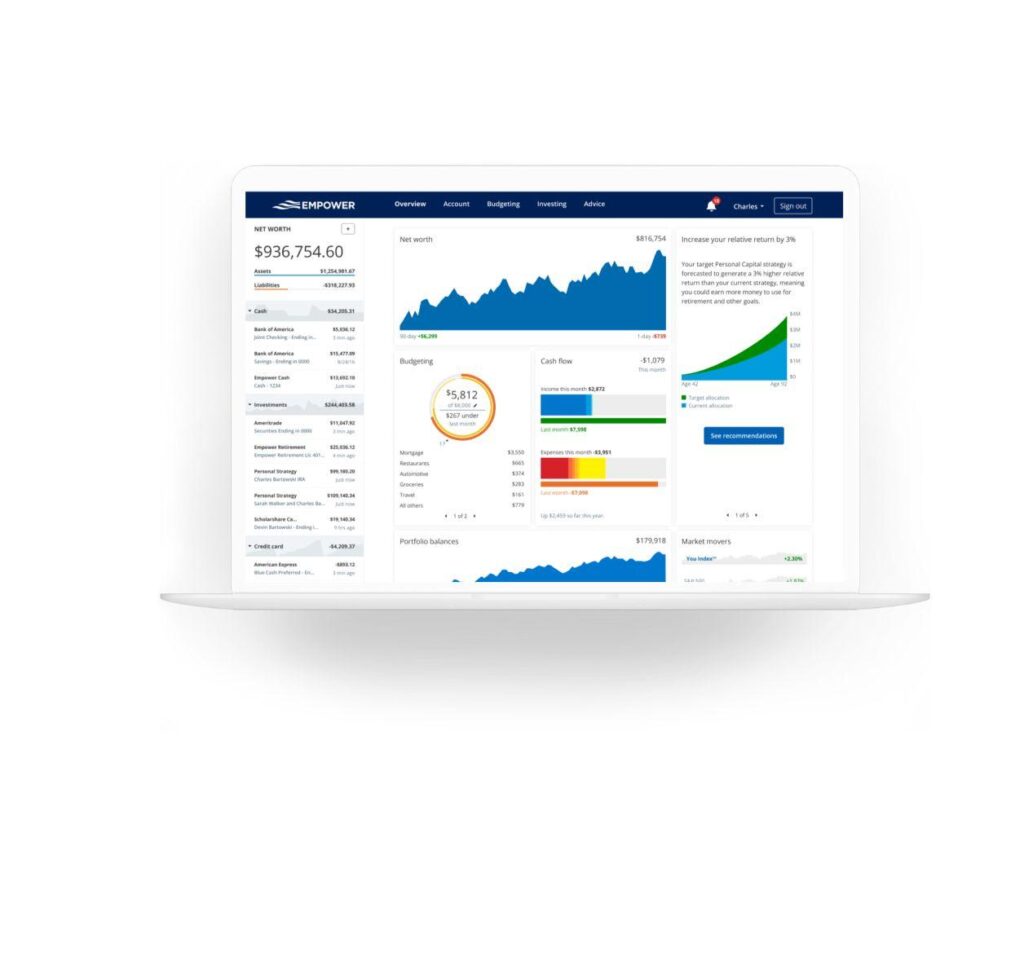

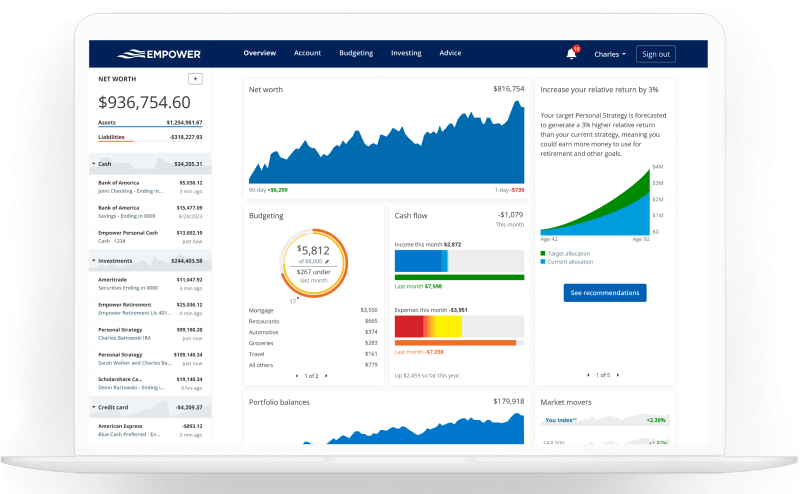

There are several key considerations to keep in mind when selecting an online investment platform. First, evaluate the platform’s fees and commission structure. Look for transparent and competitive pricing to ensure that you maximize your investment returns. Pay attention to the platform’s customer support availability and responsiveness. Prompt and reliable support can be crucial when encountering issues or needing assistance with your investments. Finally, assess the platform’s educational resources and tools. A platform that offers comprehensive educational materials and intuitive tools can help you make informed investment decisions and enhance your overall investing experience.

Key Features to Look for

When evaluating online investment platforms, consider the key features they offer. Look for platforms that provide real-time market data and news, as well as analytical tools to help you evaluate investment opportunities. A user-friendly trading interface with customizable options can make trading more efficient and tailored to your specific needs. Additionally, consider platforms that offer portfolio tracking and performance analysis tools. These features allow you to monitor the progress of your investments and make adjustments as needed. Integration with mobile devices and responsive design is also important for investors who prefer to manage their portfolios on the go.

Setting Financial Goals

Identifying Your Financial Goals

Before diving into online investing, it’s important to identify and define your financial goals. These goals will guide your investment strategy and help you stay focused and disciplined. Start by considering what you want to achieve financially. Are you investing to fund a comfortable retirement, save for a down payment on a house, or achieve financial independence? Defining your financial goals will give you a clear sense of direction and purpose as you embark on your investment journey.

Long-term and Short-term Goals

Financial goals can be categorized into long-term and short-term goals. Long-term goals typically span over several years or even decades, and they often involve major life milestones, such as retirement or funding a child’s education. Short-term goals, on the other hand, have a time horizon of less than five years and could include saving for a vacation, purchasing a car, or paying off debt. It’s important to establish a balance between long-term and short-term goals to ensure you have a comprehensive financial plan that addresses both immediate needs and future aspirations.

Creating a Realistic Plan

Once you have identified your financial goals, it’s time to create a realistic plan to achieve them. Start by assessing your current financial situation, including your income, expenses, and existing assets. This evaluation will help you determine how much you can afford to invest and how much risk you are willing to take. Set specific, measurable, achievable, relevant, and time-bound (SMART) goals to keep yourself accountable and motivated. Consider consulting with a financial advisor who can provide guidance and help you develop a customized investment plan that aligns with your goals and risk tolerance.

Building Wealth with Online Investing

Diversifying Your Portfolio

Diversification is a fundamental principle of successful investing. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the impact of individual investment losses and enhance the potential for long-term growth. Online investing platforms provide easy access to a wide range of investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate investment trusts (REITs). By diversifying your portfolio and carefully selecting investments across these asset classes, you can reduce risk and increase the likelihood of achieving your financial goals.

Understanding Asset Allocation

Asset allocation refers to the process of dividing your investment portfolio among different asset classes based on your risk tolerance, investment objectives, and time horizon. The three main asset classes are equities, fixed income, and cash equivalents. Equities, also known as stocks, represent ownership in a company and offer the potential for high returns but also come with higher risks. Fixed income investments, such as bonds, provide regular interest payments and are generally considered less volatile than stocks. Cash equivalents, including money market funds and certificates of deposit (CDs), offer stability and liquidity but typically generate lower returns. It’s essential to strike the right balance between these asset classes to optimize the risk-reward profile of your portfolio.

Evaluating Investment Options

When building wealth through online investing, it’s crucial to carefully evaluate investment options. Thoroughly research each investment opportunity and consider factors such as historical performance, financial health of the underlying company or issuer, industry trends, and any associated risks. It’s also important to diversify within each asset class to further protect your investment portfolio. Be mindful of fees and expenses associated with each investment, as excessive costs can erode your overall returns. Regularly review and monitor your investments to ensure they continue to align with your financial goals and make adjustments as necessary.

Investing in Stocks and Bonds

Understanding Stocks

Stocks represent ownership stakes in publicly traded companies. When investing in stocks, you become a shareholder and have the potential to benefit from the company’s growth and profitability. Stocks can provide significant returns over the long term but also come with higher volatility and risk. Online investing platforms offer access to a wide range of stocks, from large-cap companies to small-cap companies, domestic to international markets, and various sectors. It’s important to carefully evaluate the financial health of the company, its competitive position in the industry, and market trends before investing in individual stocks.

Types of Bonds

Bonds are debt instruments issued by governments, municipalities, and corporations to raise capital. When you invest in bonds, you are effectively lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds are generally considered less risky than stocks but offer lower potential returns. They can provide stability to a portfolio and act as a hedge against stock market volatility. There are different types of bonds, including government bonds, corporate bonds, municipal bonds, and Treasury bonds. Each type has varying levels of risk and return, so it’s important to understand the specifics of each bond before adding it to your portfolio.

Risks and Rewards of Stock and Bond Investing

Both stock and bond investing come with their own set of risks and rewards. Stocks have the potential for high returns but also carry a higher level of risk due to market volatility and company-specific factors. Bond investing offers regular income through interest payments and tends to be less volatile, providing stability to a portfolio. However, bond prices can be influenced by changes in interest rates, credit ratings, and economic conditions. It’s important to carefully assess your risk tolerance, investment objectives, and time horizon when deciding on the mix of stocks and bonds in your portfolio. A well-diversified portfolio that combines both asset classes can provide a balance of growth potential and stability.

Exploring Mutual Funds and Exchange-Traded Funds (ETFs)

What Are Mutual Funds?

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional portfolio managers who make investment decisions on behalf of the fund’s shareholders. Mutual funds offer investors the opportunity to access a diversified portfolio, even with relatively small investment amounts. They can be categorized into various types, such as equity funds, bond funds, index funds, sector funds, and more. Investors in mutual funds own shares in the fund and benefit from the fund’s gains and distributions, but they are also subject to any associated fees and expenses.

What Are ETFs?

Exchange-traded funds (ETFs) are similar to mutual funds in that they are investment funds that pool money from multiple investors. However, ETFs trade on stock exchanges like individual stocks, enabling investors to buy and sell them throughout the trading day at market prices. ETFs typically aim to replicate the performance of a specific index or asset class, such as the S&P 500 or a particular sector. They offer investors exposure to a wide range of assets and allow for diversification within a single investment. Like mutual funds, ETFs charge fees and expenses, and investors can buy and sell shares at prevailing market prices.

Comparing Mutual Funds and ETFs

Both mutual funds and ETFs offer advantages and considerations that investors should analyze when making investment decisions. Mutual funds are usually actively managed, with professional portfolio managers making investment decisions. This can result in higher fees but also potentially better performance through active stock selection and asset allocation. ETFs, on the other hand, are generally passively managed and aim to replicate the performance of a specific index. They tend to have lower expense ratios, but their performance is directly linked to the index they track. ETFs offer intraday trading flexibility, while mutual funds are priced at the end of the trading day. Evaluating your investment goals, risk tolerance, and investment strategy will help determine which option is more suitable for your specific needs.

Investing in Real Estate

Understanding Real Estate Investment Options

Real estate investing involves purchasing, owning, and managing properties with the expectation of generating income and/or capital appreciation. Online investing platforms have made real estate investing more accessible and convenient for individual investors. There are several ways to invest in real estate online, such as directly purchasing properties, participating in real estate crowdfunding or peer-to-peer lending platforms, or investing in real estate investment trusts (REITs). Each option has its own unique features, benefits, and risks, so it’s important to evaluate which approach aligns with your investment goals and risk tolerance.

Benefits and Risks of Real Estate Investing

Real estate investing offers a range of advantages, including potential rental income, tax benefits, diversification, and the potential for long-term value appreciation. Real estate can provide a stable income stream through rental payments, particularly in areas with high demand. Additionally, real estate investments have the potential to hedge against inflation and provide favorable tax advantages, such as mortgage interest deductions and depreciation allowances. However, real estate investing also comes with risks, such as property value fluctuations, maintenance and repair costs, vacancy periods, and regulatory changes. It’s essential to thoroughly research and analyze potential real estate investments and consider consulting with professionals or experienced investors before committing your capital.

Considering Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-generating real estate assets. Investing in REITs allows individuals to participate in real estate investments through the purchase of shares, similar to investing in stocks. REITs offer several advantages, including diversification, professional management, liquidity, and regular dividend distributions. REITs typically focus on specific sectors of the real estate market, such as residential, commercial, industrial, or healthcare properties. By investing in REITs, individuals can access real estate opportunities without the need to directly purchase and manage properties. However, it’s important to consider the performance of the specific REIT, its underlying assets, fees, and diversification within the portfolio, as these factors can significantly impact investment outcomes.

The Rise of Cryptocurrencies

Exploring the World of Cryptocurrencies

Cryptocurrencies have gained significant attention and popularity in recent years. They are digital or virtual currencies that utilize cryptography for secure transactions and control the creation of new units. Cryptocurrencies are decentralized and operate on blockchain technology, which ensures transparency and eliminates the need for intermediaries like banks. Bitcoin, created in 2009, was the first widely recognized cryptocurrency, and it paved the way for the development of numerous other cryptocurrencies, known as altcoins. Exploring the world of cryptocurrencies can be exciting and potentially lucrative, but it’s important to understand the unique characteristics, risks, and opportunities associated with this emerging asset class.

Understanding Bitcoin and Altcoins

Bitcoin is often referred to as the pioneer and flagship cryptocurrency. It relies on a decentralized network of computers known as miners to validate and secure transactions. Bitcoin has been subject to extreme price volatility, which has both attracted investors seeking high returns and raised concerns about its stability as a form of currency. Altcoins, on the other hand, encompass all other cryptocurrencies except Bitcoin. Altcoins vary in design and purpose, with some focusing on privacy, speed of transactions, or other specific features. Each cryptocurrency has its own unique technology, value proposition, and degree of adoption, making it vital for investors to conduct thorough research and evaluate the investment merits and risks of each particular cryptocurrency.

Risks and Opportunities in Cryptocurrency Investing

Cryptocurrency investing comes with both risks and opportunities. On the risk side, cryptocurrencies are highly volatile and subject to price fluctuations that can occur rapidly and dramatically. Regulatory uncertainty, security vulnerabilities, and market manipulation are additional risks to be aware of. Investing in cryptocurrencies also requires technical knowledge and a deep understanding of the underlying technology. On the opportunity side, cryptocurrencies offer potential for high returns, especially in the early stages of their adoption. They provide exposure to innovative technologies and disruptive financial systems. It’s important to approach cryptocurrency investing with caution, conduct thorough due diligence, and only invest an amount that you can afford to lose. Diversification and long-term perspective are key to managing the risks associated with this asset class.

Investing for Retirement

The Importance of Retirement Planning

Retirement planning is crucial for anyone who wants to achieve financial independence and security in their later years. Online investing platforms provide individuals with the tools and resources to effectively plan and manage their retirement investments. Start by estimating your future retirement expenses and determining how much income you will need to cover your living costs. Consider factors such as inflation, healthcare expenses, and potential lifestyle changes. By starting early and regularly contributing to retirement accounts, you can take advantage of compound interest and maximize your savings potential. Remember that retirement planning is a lifelong process, and it’s important to periodically review and adjust your investment strategy as your circumstances change.

Choosing Retirement Accounts

When investing for retirement, individuals have access to various types of retirement accounts, each offering different tax advantages and contribution limits. Employer-sponsored retirement plans, such as 401(k) or 403(b) plans, allow individuals to contribute a portion of their pre-tax income and potentially receive employer matching contributions. These plans offer a tax-deferred growth, meaning you won’t pay taxes on the contributions or investment gains until you withdraw the funds in retirement. Individual Retirement Accounts (IRAs), such as Traditional IRAs and Roth IRAs, provide personal retirement savings options with their own contribution limits and tax implications. Carefully evaluate each retirement account option, considering factors such as eligibility criteria, contribution limits, tax implications, and investment options, to determine which one suits your needs and goals.

Strategies for Retirement Investing

When investing for retirement, it’s important to adopt strategies that align with your time horizon, risk tolerance, and goals. Asset allocation is a crucial element of retirement investing, as it helps balance risk and return based on your age and investment objectives. As retirement approaches, many individuals choose to shift their investments towards more conservative asset classes to preserve capital and reduce volatility. Regularly rebalancing your portfolio ensures it remains aligned with your desired asset allocation and risk preferences. It’s also important to periodically review your retirement plan and make adjustments based on changes in your personal circumstances, market conditions, and retirement goals. Seeking professional advice from a financial advisor specializing in retirement planning can help you develop a strategy tailored to your specific needs.

Education and Resources for Online Investors

Learning Opportunities for Online Investors

Continuous learning is crucial for successful online investing. Thankfully, there are abundant educational resources available to support your investment journey. Many online investment platforms offer educational materials, including articles, tutorials, webinars, and videos, to help investors understand investment concepts, strategies, and tools. Take advantage of these resources to improve your financial literacy and stay informed about market trends and investment opportunities. Additionally, there are reputable financial websites, online courses, and books that cover a wide range of investment topics. Engage in communities and forums where like-minded investors share insights, experiences, and best practices. Remember, investing is a lifelong learning process, and the more knowledge you accumulate, the better equipped you will be to make informed investment decisions.

Utilizing Online Investment Tools

Online investment platforms offer a variety of tools and features to assist investors in their decision-making process. These tools can range from stock screeners and financial calculators to portfolio trackers and risk assessment instruments. Stock screeners help investors filter through vast amounts of data to identify investment opportunities based on specific criteria, such as earnings growth, dividend yield, or industry sector. Financial calculators assist in assessing the potential outcomes of investments, including compound interest, savings goals, and retirement projections. Portfolio trackers provide real-time updates on the performance of your investments, allowing you to monitor progress and make informed decisions. Utilize these online investment tools to enhance your analysis, save time, and gain valuable insights into your investments.

Seeking Professional Advice

While online investing provides individual investors with greater control and autonomy, there may still be times when seeking professional advice proves beneficial. Financial advisors can offer expertise, experience, and personalized guidance tailored to your unique circumstances and goals. They can help you develop a comprehensive financial plan, assess your risk tolerance, construct a properly diversified portfolio, and provide ongoing support and monitoring. When choosing a financial advisor, consider their qualifications, credentials, areas of specialization, and fees. A good financial advisor should prioritize your best interests and work collaboratively with you to achieve your financial goals. Remember that collaborating with a financial advisor does not mean relinquishing control; rather, it can empower you to make informed decisions and navigate complex investment landscapes more confidently.

In conclusion, online investing offers individuals the opportunity to grow their wealth and achieve financial goals from the comfort and convenience of their own homes. By understanding the basics of online investing, choosing the right investment platform, setting realistic financial goals, building a diversified portfolio, and exploring various investment options, you can embark on a successful investment journey. Whether you’re interested in stocks, bonds, mutual funds, ETFs, real estate, cryptocurrencies, or retirement investing, educating yourself, utilizing online tools, and seeking professional advice can empower you to make informed investment decisions and secure your financial future. Remember that investing is a long-term endeavor, and it’s important to stay patient, disciplined, and proactive in managing your investments.